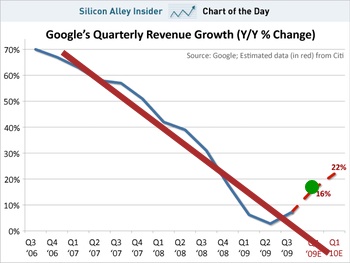

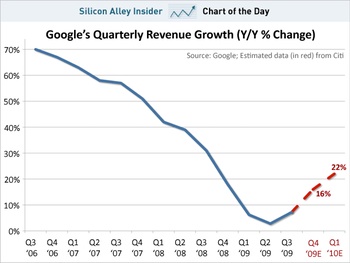

It’s no secret that the high-growth venture-capital-driven Internet industry is a hype-laden circus of misinformation. But today’s Chart of the Day from Silicon Alley Insider (right) really takes the biscuit.

Here we see that since Q3 of 2006, Google’s quarterly revenue growth has steadily declined from a cancerous 70% year-on-year to under 10% for the last three quarters.

Now there’s nothing wrong with an 8% growth rate. That’s pretty much up there with China, for instance. And the only countries growing faster than China are starting from a very low base. Think of such economic powerhouses as Angola, Bhutan, Rwanda and Timor-Leste.

OK, I know countries and companies aren’t the same thing, but that’s not my point.

Look at the bottom right of that first graph.

Citi reckons that Google’s growth in the next two quarters will increase in a more-or-less straight line that’s even steeper than that most recent quarter-on-quarter increase. Based on fucking what, Citi? That’s the only quarter showing growth in the entire chart!

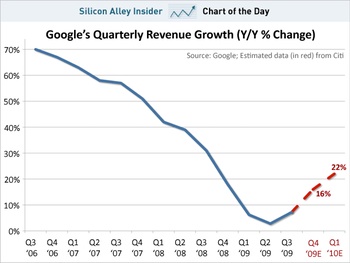

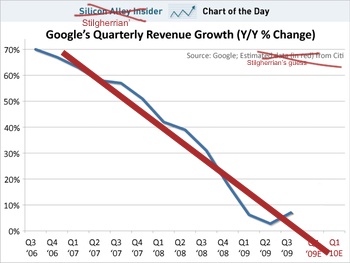

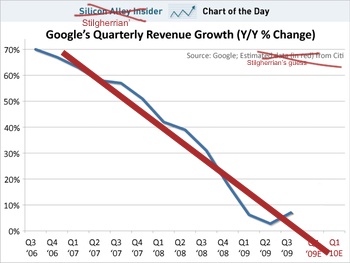

Surely this second graph is a more realistic projection based on the data available.

There’s precisely zero science here. I just grabbed the straight-line tool in my graphics program and drew in a red line by eye. I certainly couldn’t be arsed doing this properly with, you know, mathematics. But…

Honestly, which of these “projections” looks more realistic to you?

As I say, there’s no science here. Perhaps we can add some analysis.

What factors might be affecting Google’s potential for increased revenue growth?

On the plus side:

- Google is operating in a marketplace which is still growing, and perhaps even growing faster than last year as we emerge from the global financial crisis. Then again, so is everyone else.

- Google’s got a new product line coming out, those Android phone thingamabobs, and people are wetting themselves to get one. Well, at least until Apple reveals their new toy next week.

- Google pwns the Internet.

- What else?

But working against that:

- Google is subject to increased competition, especially from Microsoft’s Bing and related products and services.

- Rupert Murdoch is up to something, although admittedly he might not have the faintest idea what he’s doing.

- Every market eventually reaches a plateau. The key bullshit image of the first dot.com boom was the classic revenue projection of a start-up: exponential growth continuing forever. Well, here in rich white Western countries, all the folks who are using the Internet are pretty much there already. There might be more volume of data, but the amount of attention span you can sell to advertisers ain’t going to rise so much.

- What else?

We also need to remember that these are revenue figures, not profit. And that’s my core point. Simplistic “Oooh, aah!” gawking over one numerical measure without context is wankery. Why do we let analysts get away with it?

All that said, I’m no financial analyst. What would I know? So if you know better, set me straight. There’s a “Reply” box below…

Oh, and Google’s Q4 revenue figures will be announced tomorrow. So we’ll have one more real data point then. Stand by.