I knew the first three months of 2015 had been bad for business — or at least my little patch of business — but I hadn’t realised it was this bad. Turns out it was my second-worst quarter in more than four years! Drastic action and ruthless decisions are required.

Yes, this is another of my occasional thinking-aloud reflections on my personal circumstances. If you don’t like this sort of thing, then stop reading now. Read this instead.

Still with me? Lovely.

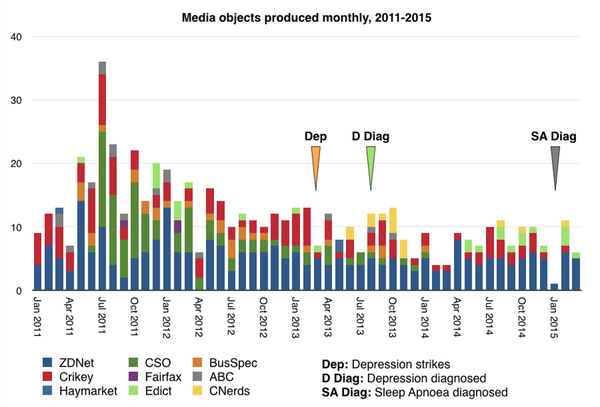

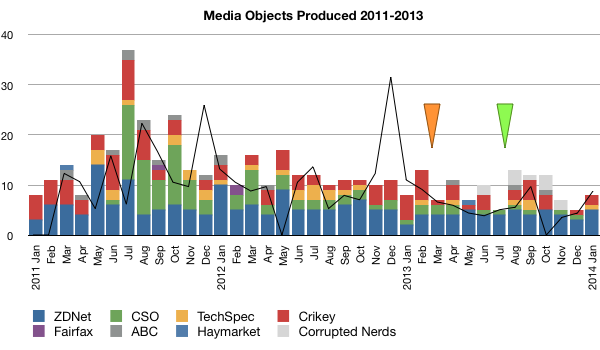

Yesterday I updated my “media objects” chart, which counts how many things I’ve created for each media outlet, regardless of relative complexity or what income was generated. It serves as a handy proxy for revenue — because certain revenue figures are confidential.

It’s a depressing image. At best, Q1 of 2015 was no worse than Q1 of the previous year, but overall it’s still a picture of decline. Literally depressing, in fact, because I’ve left in a couple of health-related markers that I was using to analyse something else.

Back at the end of 2012, I’d tried to inject a little more strategy into the way I ran the business side of making media. This and other charts were some of the tools I created, last updated in February 2014. It’s fair to say that I haven’t really developed any kind of strategy out of the information in those charts, and this new chart illustrates the results from doing that nothing. Go me.

This chart doesn’t reflect certain positives, however. There’s now crowdsourced funding for The 9pm Edict podcast. I also do some minor work for the University of Technology Sydney, and I consult on some other media projects too. There’s also fragmentary revenue from the legacy clients of my IT business.

But I do need to raise my income levels back to something more like they were a few years ago. The next step is to do something about it. And that has been the nature of my ponderings across this Easter long weekend.